Alibaba, Tencent, SoftBank corner Amazon and Uber to become the biggest allies of India’s digital entrepreneurs

The moves undertaken by local and global internet players clearly indicate that the strong are getting stronger in the Indian internet ecosystem.

When online grocer Bigbasket went to market in early 2017 to raise capital just a year after securing $150 million, the list of suitors was very different. In March 2016, it had closed funding from US- and Middle East-based financial investors including Sands Capital, IFC and Abraaj Capital. This time, the interested ones were major corporations—Chinese strategic investors Tencent, conglomerate Fosun, ecommerce giant Alibaba along with Paytm Mall, and, of course, US-based Amazon.

In fact, Amazon had engaged with Bigbasket for an acquisition on multiple occasions since late 2015 but the talks didn’t progress because of valuation and deal structuring issues.

Some of Bigbasket’s investors were also worried that Amazon would not follow through with an offer after obtaining the details of the business through due diligence, according to people familiar with the matter. “Amazon wanted to invest in Bigbasket while also running their own grocery operations, which doesn’t make sense,” one of them said.

Alibaba was quick to take advantage of this situation and signed an exclusivity period for negotiations with Bigbasket in June.

“Amazon had spent more time on the investment as compared to Alibaba, but Alibaba was more entrepreneur-friendly,” said the person quoted above. Also, while Amazon wanted a clear path to complete the acquisition, Alibaba was open to an outcome like a public offering in the future, this person said.

The Bigbasket deal, which is in the final stages of completion, may not be the last time such a scenario plays out in India, with US and Chinese internet giants fighting to mark their territories here. This is happening elsewhere already, involving online food-delivery firms Swiggy and Zomato as well as movie-ticketing platform Bookmyshow. The founders of these companies are weighing if they should align with one of the internet giants or raise money from financial investors.

This underlines that the proxy war is now going beyond the Unicorns, or billion-dollar valuation internet companies, according to about a dozen entrepreneurs, investors and executives ET spoke with for this article.

GAME IS ON

In 2016, it seemed like the US-based Amazon and Uber would corner market leadership against the homegrown leaders, Flipkart and Ola, respectively. The rise of these domestic companies had given hope to technology entrepreneurs here that India would be able to create local champions in ecommerce, especially as Google and Facebook already dominated the online search and social media markets.

Last year, though, Flipkart and Ola held their own, racing ahead of the American rivals with better execution and recouping from strategic errors made in 2015. But capital remains the primary requirement, followed by on-ground execution and technology know-how, which is not a strong point of financial investors. “Americans are certainly out-executing local entrepreneurs… What is happening now is the Chinese are lining up with Indian entrepreneurs but they don’t want control,” said a Gurgaon-based venture capital investor.

Chinese internet giants Alibaba and Tencent, and investors such as Japan’s SoftBank and South Africa’s Naspers that made money by backing these companies, have emerged as the biggest allies of local internet companies. SoftBank’s 28% stake in Alibaba is worth more than its own market capitalisation.

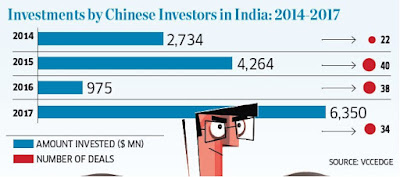

That’s true also for Naspers with respect to Tencent. Both SoftBank and Naspers have their fates tied to their Chinese investments, and by working with the Chinese companies they are looking to recreate that success in India as well. (see graphic) Take this statistic. Each of India’s four most-valued internet companies— Flipkart, Ola, mobile payments platform Paytm, and online travel agency Makemytrip—are more than 40% owned by Chinese corporations together with Naspers and SoftBank, the biggest beneficiaries of the rise of China’s internet giants.

INDIAN INTERNET OPPORTUNITY: BETWEEN YELLOW AND RED LIGHTS

The growth of the Indian internet market has been much slower than expected, something that investors who poured in billions of dollars between 2014 and 2015 have realised. Online retail has seen the highest amount of investments, where growth is expected to be much slower than in China.

Last year, US research firm Forrester slashed its projections for online retailing in India by more than one-third to $48 billion by 2020, citing demonetisation, ecommerce restrictions, dwindling funding, and slow customer acquisition. But the promise remains, as Forrester added that India continues to be the fastest-growing online retail market, ahead of South Korea and China.

“In the past 3-4 years, we went through a hype scenario and then a correction. The realisation that everyone came to is that India is slower to adopt and buyers are more conscious about how much they spend. It takes longer to establish habitual behaviour here,” said Ash Lilani, managing partner at venture capital firm Saama Capital, which was an early investor in Paytm and Snapdeal.

This realisation put many Indian internet companies that had raised capital at sky-high valuations in 2014 and 2015 between a rock and a hard place. They did not have the scale or the bottomline to go for a public listing of their shares. But they still needed capital, which financial investors were not willing to provide given the uncertainty of their leadership positions as their battles with US giants heated up.

ENTER THE STRATEGICS

One major factor that compelled some domestic companies to seek out strategic investors was that unlike China, India is an open market and overseas competition will come sooner or later. Paytm was the first to raise capital from a Chinese strategic investor, when Alibaba’s payments affiliate Ant Financial backed it in early 2015. Nasdaq-listed Makemytrip, which was facing aggressive competition from Naspers-owned Ibibo, was the next when it raised capital from Chinese peer Ctrip in January 2016.

Flipkart and Ola began improving their unit economics while also seeking additional capital at valuations lower than their 2015 peaks. The companies turned to strategic investors who could provide longer-term capital as well as technology know-how.

“Earlier, strategics used to run away after seeing negative gross margins as they known what is an investment and what is money down the drain,” said the founder of an ecommerce startup who has negotiated with multiple strategic investors. “Since companies are getting closer to profitable or better unit economics, strategics are taking a more serious interest.”

Also, companies like Alibaba and Tencent have been looking to establish their presence in India as they expand globally, and have seen their US rivals already establish a significant beachhead here.

There are several reasons why US and Chinese companies have taken different approaches in India. US corporations did not face language barriers, were comfortable doing business in India because of the IT services industry, and companies like Amazon and Google had India development centers and many senior executives from India.

“Many like Amazon and Google struggled in China and didn’t want to lose India as well. For all these reasons (above), they feel they can enter India and take on incumbents here. In contrast, companies like Alibaba and Tencent are not yet comfortable operating in India because that precedent simply doesn’t exist,” said Kartik Hosanagar, professor at The Wharton School. “This will be true in the near future as well. That said, there is no reason why this can’t change in 10 years.”

RACE FOR ECOSYSTEMS: WITH US OR AGAINST US

As Indian companies have been able to raise large amounts of long-term capital, the race now is to build an ecosystem of services organically, through acquisitions or investments, or in rare cases, partnerships. This is where both Indian and US companies are learning from Alibaba and Tencent, which made a slew of investments across ride-hailing, hyper-local services and delivery, travel, and couponing to help their payments platforms take off.

Paytm has been doing that since the start of 2017, buying majority stakes in a slew of companies including deals platforms Nearby and Little, events ticketing player Insider, and online lender Creditmate. Larger investments such as in Bigbasket are being led by Alibaba, a template likely to be followed by others.

Flipkart has also started building its own ecosystem with the backing of Tencent and Naspers, but has not closed any investments yet. Ola is expanding the scope of its services to areas like food delivery with the recent acquisition of Foodpanda. It has also started investing in its Ola Money platform. And then, there are operators like Reliance Jio that are rolling out their services across segments organically.

Amazon and Google, too, have become more active the past few months. Facebook is also a potential entrant in the space.

“Clearly, all signs are pointing in that direction of what happened in China 8-10 years ago, when BAT (Baidu, Alibaba and Tencent) was created. India also has 5-6 contenders,” said Tarun Davda, managing director at venture capital firm Matrix Partners India, which also has affiliates in the US and China. “I think, eventually, there will be 3-4 ecosystems in India over the next 2-3 years.”

Experts tracking the space feel that the scope of services on offer by these companies will be a lot more as compared to what the US or Chinese peers offered at this stage of evolution. Part of it is driven by the fact that the market is growing slower than expected. Another driver is an ambition to own a larger piece of the cake.

Flipkart, Amazon India, Google, Facebook and Paytm have all seen their registered customer bases swell to over 100 million.

“It is basically grabbing land. They will be more aggressive entering new categories and segments because they have to show growth. Also, once you have a captive customer base it is easy to upsell and add products,” said Lilani of Saama Capital.

All large digital commerce companies are realising that they will have to align with one of these ecosystems. Bigbasket is not the only case. Bookmyshow and Swiggy, expected to emerge as the next Unicorns from India, have held talks with strategic investors Flipkart, Amazon, and Paytm-Alibaba. “Most of the companies will eventually see an outcome where you have to be a part of one of these ecosystems and you will get very tempting offers as well,” said the founder of an ecommerce company who was a part of such discussions.

DOWN TO BRASS TACKS

The moves undertaken by local and global internet players clearly indicate that the strong are getting stronger in the Indian internet ecosystem. Major segments of Indian internet like online retail (Flipkart, Amazon India), online advertising (Google, Facebook), online travel (Makemytrip, Oyo Rooms), food delivery (Zomato, Swiggy), mobile payments (Paytm) and ride-hailing (Ola, Uber) have seen consolidation pick up over the last 24 months, where 1-2 large players have emerged as against half a dozen players competing earlier. This has limited growth in each of these segments to companies backed by one of the strategic investors, due to factors ranging from raw capital muscle to better execution knowhow.

“Indian market is seeing a very clear consolidation way ahead of its time. At the stage of growth India is in, you cannot have a duopoly kind of environment. You need to have at least 5-6 companies,” said the India head of a multinational internet company.

This means that in several categories there is no room left for a new entity or any disruption at least for the next 2-3 years, say experts. Entrepreneurs are also increasingly entering areas like software, business-to-business (B2B) sectors and financial technology. The share of B2B startups among new ventures in 2017 was 47%, as compared to 34% in 2016, show Nasscom data. Growth in commerce startups was just 13%, as compared to 31% in fin-tech and 28% in health-tech.

“In the war that started for the Indian ecosystem, it was becoming clear that US companies would win, but that didn’t happen. Now, Indian companies have shot back with a lot of capital and are seriously looking to build their ecosystems. The result date of the battle has been shifted for at least 2-3 years and the prize money is huge,” said the online retail entrepreneur mentioned above.

THE GAME OF ECOSYSTEMS

THE AMERICANS

AMAZON: The Seattle-based technology giant has committed $5 billion to its India unit and built a signifi cant presence in online retail and cloud services here. Building out a big global seller platform, its B2B platform, and its payments business is next on its agenda. The corporate development team is scouting for investments in the financial technology space.

GOOGLE: India is becoming the main lab for the search engine giant’s Next Billion Users (NBU) initiative. Google has built a highly profi table business in India over the past decade and reported a revenue of Rs 7,208 crore for FY17. Now, it’s getting into investment mode, spending crores of rupees daily on discounts and rewards on its payments app Tez and hyper-local delivery and services app Areo. Google is also actively scouting for investments, and recently led a funding round in hyper-local concierge and delivery player Dunzo.

FACEBOOK: India became the largest market for Facebook with more than 241 million monthly active users last year, but in FY17 it earned just Rs 341.8 crore in revenue from India against its global revenue of Rs 178,000 crore. But with the upcoming launch of a payments facility on messaging app WhatsApp, which Facebook owns, and the company’s formal entry into social commerce, more could come.

JOKER IN THE PACK JIO: The telecom unit of Mukesh Ambani’s Reliance Industries has built a base of 136.8 million customers in less than two years since launch. With a captive customer base, ready content to keep its customers engaged, its presence in payments, and plans to get into commerce, Jio could emerge as a formidable competitor. It also holds signifi cant minority stakes in movie-ticketing portal Bookmyshow, travel player Yatra, and HomeShop through its acquisition of Network18.

SOFTBANK: HEADS I WIN, TAILS YOU LOSE

The Japanese telecom and internet major is in a position where it will emerge as a winner in India, one way or another. This became evident when SoftBank chose to back online retail market leader Flipkart in 2017 after it realised that its original investment in the space, Snapdeal, was not able to reach market leadership.

SoftBank also holds stakes in both the major ride-hailing players in India, Ola and Uber. It backs mobile payments market leader Paytm, but also has a toehold into Flipkart’s payments unit Phonepe through its investment in the online retailer. Many industry experts believe SoftBank will ultimately align with Alibaba, in which it is the largest shareholder with about 28% stake. Whether Soft-Bank moots a merger between Flipkart and Paytm remains to be seen. Given its $100-billion fund, any winner in the Indian market will need Soft-Bank by its side.

HINDI-CHINI BHAI BHAI

PAYTM, BACKED BY ALIBABA: Alibaba, the Chinese ecommerce giant, established a solid footing in India when its payments affi liate Ant Financial decided to partner with Vijay Shekhar Sharma’s Paytm in 2015. Since then, Alibaba and Ant have together committed close to $1.6 billion to India, with deals under the works in both Bigbasket and XpressBees, thus establishing a presence in online commerce, payments, and logistics.

FLIPKART, BACKED BY NASPERS & TENCENT: While South African media giant Naspers has been investing in India for over a decade with investments in MakeMyTrip and Flipkart, Tencent made its presence felt last year by taking stakes in both Flipkart and Ola. Unlike Alibaba, Tencent is known more as a handsoff investor but many would attempt to emulate the WeChat owner’s success in China here. Naspers is the largest shareholder in Tencent, with more than a 30% stake. Naspers also owns payments company PayU and OLX, which have a signifi cant presence in India, and a stake in food-delivery player Swiggy.

OLA: India’s largest ride-hailing player cemented its market leadership in 2017 and is getting ready to expand into food delivery with the acquisition of Foodpanda India. Its payments business will also see a serious push this year, along with a potential entry into grocery delivery. CEO Bhavish Aggarwal may have more surprises in store.

When online grocer Bigbasket went to market in early 2017 to raise capital just a year after securing $150 million, the list of suitors was very different. In March 2016, it had closed funding from US- and Middle East-based financial investors including Sands Capital, IFC and Abraaj Capital. This time, the interested ones were major corporations—Chinese strategic investors Tencent, conglomerate Fosun, ecommerce giant Alibaba along with Paytm Mall, and, of course, US-based Amazon.

In fact, Amazon had engaged with Bigbasket for an acquisition on multiple occasions since late 2015 but the talks didn’t progress because of valuation and deal structuring issues.

Some of Bigbasket’s investors were also worried that Amazon would not follow through with an offer after obtaining the details of the business through due diligence, according to people familiar with the matter. “Amazon wanted to invest in Bigbasket while also running their own grocery operations, which doesn’t make sense,” one of them said.

Alibaba was quick to take advantage of this situation and signed an exclusivity period for negotiations with Bigbasket in June.

“Amazon had spent more time on the investment as compared to Alibaba, but Alibaba was more entrepreneur-friendly,” said the person quoted above. Also, while Amazon wanted a clear path to complete the acquisition, Alibaba was open to an outcome like a public offering in the future, this person said.

The Bigbasket deal, which is in the final stages of completion, may not be the last time such a scenario plays out in India, with US and Chinese internet giants fighting to mark their territories here. This is happening elsewhere already, involving online food-delivery firms Swiggy and Zomato as well as movie-ticketing platform Bookmyshow. The founders of these companies are weighing if they should align with one of the internet giants or raise money from financial investors.

This underlines that the proxy war is now going beyond the Unicorns, or billion-dollar valuation internet companies, according to about a dozen entrepreneurs, investors and executives ET spoke with for this article.

GAME IS ON

In 2016, it seemed like the US-based Amazon and Uber would corner market leadership against the homegrown leaders, Flipkart and Ola, respectively. The rise of these domestic companies had given hope to technology entrepreneurs here that India would be able to create local champions in ecommerce, especially as Google and Facebook already dominated the online search and social media markets.

Last year, though, Flipkart and Ola held their own, racing ahead of the American rivals with better execution and recouping from strategic errors made in 2015. But capital remains the primary requirement, followed by on-ground execution and technology know-how, which is not a strong point of financial investors. “Americans are certainly out-executing local entrepreneurs… What is happening now is the Chinese are lining up with Indian entrepreneurs but they don’t want control,” said a Gurgaon-based venture capital investor.

Chinese internet giants Alibaba and Tencent, and investors such as Japan’s SoftBank and South Africa’s Naspers that made money by backing these companies, have emerged as the biggest allies of local internet companies. SoftBank’s 28% stake in Alibaba is worth more than its own market capitalisation.

That’s true also for Naspers with respect to Tencent. Both SoftBank and Naspers have their fates tied to their Chinese investments, and by working with the Chinese companies they are looking to recreate that success in India as well. (see graphic) Take this statistic. Each of India’s four most-valued internet companies— Flipkart, Ola, mobile payments platform Paytm, and online travel agency Makemytrip—are more than 40% owned by Chinese corporations together with Naspers and SoftBank, the biggest beneficiaries of the rise of China’s internet giants.

INDIAN INTERNET OPPORTUNITY: BETWEEN YELLOW AND RED LIGHTS

The growth of the Indian internet market has been much slower than expected, something that investors who poured in billions of dollars between 2014 and 2015 have realised. Online retail has seen the highest amount of investments, where growth is expected to be much slower than in China.

Last year, US research firm Forrester slashed its projections for online retailing in India by more than one-third to $48 billion by 2020, citing demonetisation, ecommerce restrictions, dwindling funding, and slow customer acquisition. But the promise remains, as Forrester added that India continues to be the fastest-growing online retail market, ahead of South Korea and China.

“In the past 3-4 years, we went through a hype scenario and then a correction. The realisation that everyone came to is that India is slower to adopt and buyers are more conscious about how much they spend. It takes longer to establish habitual behaviour here,” said Ash Lilani, managing partner at venture capital firm Saama Capital, which was an early investor in Paytm and Snapdeal.

This realisation put many Indian internet companies that had raised capital at sky-high valuations in 2014 and 2015 between a rock and a hard place. They did not have the scale or the bottomline to go for a public listing of their shares. But they still needed capital, which financial investors were not willing to provide given the uncertainty of their leadership positions as their battles with US giants heated up.

ENTER THE STRATEGICS

One major factor that compelled some domestic companies to seek out strategic investors was that unlike China, India is an open market and overseas competition will come sooner or later. Paytm was the first to raise capital from a Chinese strategic investor, when Alibaba’s payments affiliate Ant Financial backed it in early 2015. Nasdaq-listed Makemytrip, which was facing aggressive competition from Naspers-owned Ibibo, was the next when it raised capital from Chinese peer Ctrip in January 2016.

Flipkart and Ola began improving their unit economics while also seeking additional capital at valuations lower than their 2015 peaks. The companies turned to strategic investors who could provide longer-term capital as well as technology know-how.

“Earlier, strategics used to run away after seeing negative gross margins as they known what is an investment and what is money down the drain,” said the founder of an ecommerce startup who has negotiated with multiple strategic investors. “Since companies are getting closer to profitable or better unit economics, strategics are taking a more serious interest.”

Also, companies like Alibaba and Tencent have been looking to establish their presence in India as they expand globally, and have seen their US rivals already establish a significant beachhead here.

There are several reasons why US and Chinese companies have taken different approaches in India. US corporations did not face language barriers, were comfortable doing business in India because of the IT services industry, and companies like Amazon and Google had India development centers and many senior executives from India.

“Many like Amazon and Google struggled in China and didn’t want to lose India as well. For all these reasons (above), they feel they can enter India and take on incumbents here. In contrast, companies like Alibaba and Tencent are not yet comfortable operating in India because that precedent simply doesn’t exist,” said Kartik Hosanagar, professor at The Wharton School. “This will be true in the near future as well. That said, there is no reason why this can’t change in 10 years.”

RACE FOR ECOSYSTEMS: WITH US OR AGAINST US

As Indian companies have been able to raise large amounts of long-term capital, the race now is to build an ecosystem of services organically, through acquisitions or investments, or in rare cases, partnerships. This is where both Indian and US companies are learning from Alibaba and Tencent, which made a slew of investments across ride-hailing, hyper-local services and delivery, travel, and couponing to help their payments platforms take off.

Paytm has been doing that since the start of 2017, buying majority stakes in a slew of companies including deals platforms Nearby and Little, events ticketing player Insider, and online lender Creditmate. Larger investments such as in Bigbasket are being led by Alibaba, a template likely to be followed by others.

Flipkart has also started building its own ecosystem with the backing of Tencent and Naspers, but has not closed any investments yet. Ola is expanding the scope of its services to areas like food delivery with the recent acquisition of Foodpanda. It has also started investing in its Ola Money platform. And then, there are operators like Reliance Jio that are rolling out their services across segments organically.

Amazon and Google, too, have become more active the past few months. Facebook is also a potential entrant in the space.

“Clearly, all signs are pointing in that direction of what happened in China 8-10 years ago, when BAT (Baidu, Alibaba and Tencent) was created. India also has 5-6 contenders,” said Tarun Davda, managing director at venture capital firm Matrix Partners India, which also has affiliates in the US and China. “I think, eventually, there will be 3-4 ecosystems in India over the next 2-3 years.”

Experts tracking the space feel that the scope of services on offer by these companies will be a lot more as compared to what the US or Chinese peers offered at this stage of evolution. Part of it is driven by the fact that the market is growing slower than expected. Another driver is an ambition to own a larger piece of the cake.

Flipkart, Amazon India, Google, Facebook and Paytm have all seen their registered customer bases swell to over 100 million.

“It is basically grabbing land. They will be more aggressive entering new categories and segments because they have to show growth. Also, once you have a captive customer base it is easy to upsell and add products,” said Lilani of Saama Capital.

All large digital commerce companies are realising that they will have to align with one of these ecosystems. Bigbasket is not the only case. Bookmyshow and Swiggy, expected to emerge as the next Unicorns from India, have held talks with strategic investors Flipkart, Amazon, and Paytm-Alibaba. “Most of the companies will eventually see an outcome where you have to be a part of one of these ecosystems and you will get very tempting offers as well,” said the founder of an ecommerce company who was a part of such discussions.

DOWN TO BRASS TACKS

The moves undertaken by local and global internet players clearly indicate that the strong are getting stronger in the Indian internet ecosystem. Major segments of Indian internet like online retail (Flipkart, Amazon India), online advertising (Google, Facebook), online travel (Makemytrip, Oyo Rooms), food delivery (Zomato, Swiggy), mobile payments (Paytm) and ride-hailing (Ola, Uber) have seen consolidation pick up over the last 24 months, where 1-2 large players have emerged as against half a dozen players competing earlier. This has limited growth in each of these segments to companies backed by one of the strategic investors, due to factors ranging from raw capital muscle to better execution knowhow.

“Indian market is seeing a very clear consolidation way ahead of its time. At the stage of growth India is in, you cannot have a duopoly kind of environment. You need to have at least 5-6 companies,” said the India head of a multinational internet company.

This means that in several categories there is no room left for a new entity or any disruption at least for the next 2-3 years, say experts. Entrepreneurs are also increasingly entering areas like software, business-to-business (B2B) sectors and financial technology. The share of B2B startups among new ventures in 2017 was 47%, as compared to 34% in 2016, show Nasscom data. Growth in commerce startups was just 13%, as compared to 31% in fin-tech and 28% in health-tech.

“In the war that started for the Indian ecosystem, it was becoming clear that US companies would win, but that didn’t happen. Now, Indian companies have shot back with a lot of capital and are seriously looking to build their ecosystems. The result date of the battle has been shifted for at least 2-3 years and the prize money is huge,” said the online retail entrepreneur mentioned above.

THE GAME OF ECOSYSTEMS

THE AMERICANS

AMAZON: The Seattle-based technology giant has committed $5 billion to its India unit and built a signifi cant presence in online retail and cloud services here. Building out a big global seller platform, its B2B platform, and its payments business is next on its agenda. The corporate development team is scouting for investments in the financial technology space.

GOOGLE: India is becoming the main lab for the search engine giant’s Next Billion Users (NBU) initiative. Google has built a highly profi table business in India over the past decade and reported a revenue of Rs 7,208 crore for FY17. Now, it’s getting into investment mode, spending crores of rupees daily on discounts and rewards on its payments app Tez and hyper-local delivery and services app Areo. Google is also actively scouting for investments, and recently led a funding round in hyper-local concierge and delivery player Dunzo.

FACEBOOK: India became the largest market for Facebook with more than 241 million monthly active users last year, but in FY17 it earned just Rs 341.8 crore in revenue from India against its global revenue of Rs 178,000 crore. But with the upcoming launch of a payments facility on messaging app WhatsApp, which Facebook owns, and the company’s formal entry into social commerce, more could come.

JOKER IN THE PACK JIO: The telecom unit of Mukesh Ambani’s Reliance Industries has built a base of 136.8 million customers in less than two years since launch. With a captive customer base, ready content to keep its customers engaged, its presence in payments, and plans to get into commerce, Jio could emerge as a formidable competitor. It also holds signifi cant minority stakes in movie-ticketing portal Bookmyshow, travel player Yatra, and HomeShop through its acquisition of Network18.

SOFTBANK: HEADS I WIN, TAILS YOU LOSE

The Japanese telecom and internet major is in a position where it will emerge as a winner in India, one way or another. This became evident when SoftBank chose to back online retail market leader Flipkart in 2017 after it realised that its original investment in the space, Snapdeal, was not able to reach market leadership.

SoftBank also holds stakes in both the major ride-hailing players in India, Ola and Uber. It backs mobile payments market leader Paytm, but also has a toehold into Flipkart’s payments unit Phonepe through its investment in the online retailer. Many industry experts believe SoftBank will ultimately align with Alibaba, in which it is the largest shareholder with about 28% stake. Whether Soft-Bank moots a merger between Flipkart and Paytm remains to be seen. Given its $100-billion fund, any winner in the Indian market will need Soft-Bank by its side.

HINDI-CHINI BHAI BHAI

PAYTM, BACKED BY ALIBABA: Alibaba, the Chinese ecommerce giant, established a solid footing in India when its payments affi liate Ant Financial decided to partner with Vijay Shekhar Sharma’s Paytm in 2015. Since then, Alibaba and Ant have together committed close to $1.6 billion to India, with deals under the works in both Bigbasket and XpressBees, thus establishing a presence in online commerce, payments, and logistics.

FLIPKART, BACKED BY NASPERS & TENCENT: While South African media giant Naspers has been investing in India for over a decade with investments in MakeMyTrip and Flipkart, Tencent made its presence felt last year by taking stakes in both Flipkart and Ola. Unlike Alibaba, Tencent is known more as a handsoff investor but many would attempt to emulate the WeChat owner’s success in China here. Naspers is the largest shareholder in Tencent, with more than a 30% stake. Naspers also owns payments company PayU and OLX, which have a signifi cant presence in India, and a stake in food-delivery player Swiggy.

OLA: India’s largest ride-hailing player cemented its market leadership in 2017 and is getting ready to expand into food delivery with the acquisition of Foodpanda India. Its payments business will also see a serious push this year, along with a potential entry into grocery delivery. CEO Bhavish Aggarwal may have more surprises in store.

Comments

Post a Comment